Nidhi Company: A Comprehensive Overview

A Nidhi Company is a type of Non-Banking Financial Company (NBFC) that operates in India with the primary objective of cultivating the habit of savings and thrift among its members. Registered under Section 406 of the Companies Act, 2013, a Nidhi Company is governed by the Ministry of Corporate Affairs (MCA) and follows the Nidhi Rules, 2014. Unlike other NBFCs, a Nidhi Company is restricted to accepting deposits and lending money to its members, making it a unique financial institution.

Member-Centric Operations: A Nidhi Company can only deal with its members, meaning it cannot engage with external individuals or institutions.

Encourages Savings: The company fosters the habit of savings among its members, which promotes financial discipline.

Limited Liability: The liability of members is limited, protecting them from financial risks beyond their contributions.

No External Involvement: It cannot engage in chit funds, hire-purchase, leasing, or insurance businesses.

Regulated by MCA: Though it falls under the NBFC category, it is exempt from Reserve Bank of India (RBI) oversight, reducing regulatory burdens.

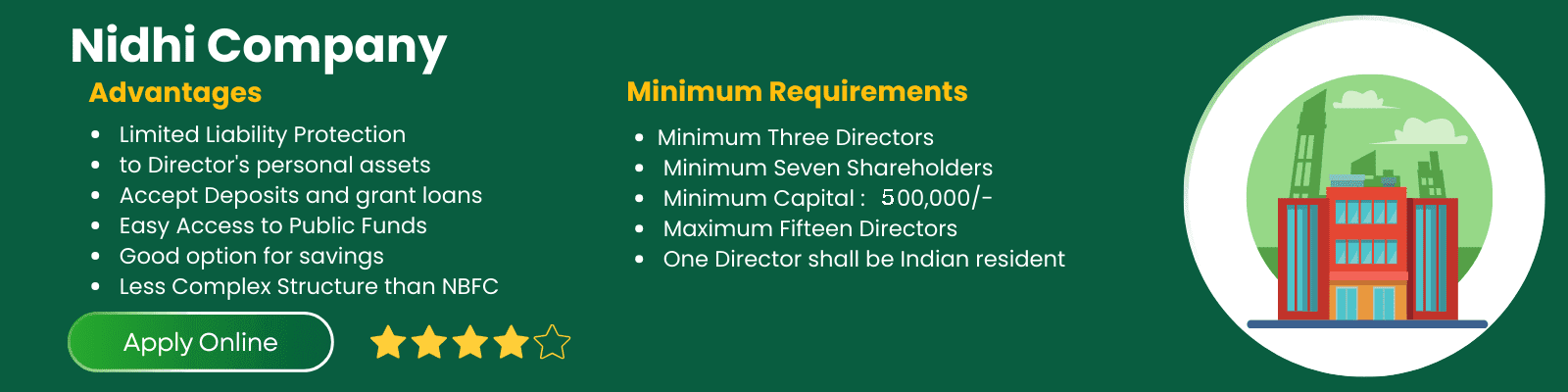

To register a Nidhi Company in India, certain eligibility criteria must be met:

Minimum Members: A minimum of seven members is required to start the company, with at least three acting as directors.

Capital Requirement: A minimum paid-up equity share capital of Rs. 5 lakh is necessary.

Unique Name: The company’s name must include the word “Nidhi Limited.”

No Preference Shares: A Nidhi Company cannot issue preference shares.

Obtain Digital Signature Certificate (DSC): Directors must have DSCs for online registration.

Director Identification Number (DIN): All directors need a DIN issued by the MCA.

Reserve a Name: The company’s name must be unique and should be approved by the MCA.

Draft Memorandum and Articles of Association: These legal documents define the company’s objectives and operational framework.

File Incorporation Application: The final application is submitted to the MCA along with required documents and fees.

Obtain Certificate of Incorporation: Once approved, the company is legally recognized as a Nidhi Company.

Membership: A Nidhi Company must have at least 200 members within one year of incorporation.

Net-Owned Funds (NOF): The ratio of Net Owned Funds to deposits should be 1:20.

Loan Limits: The company can provide secured loans only against gold, property, or fixed deposits.

Branch Expansion: A Nidhi Company can open branches only after three years of successful operations and within the same state.

Interest Rate Cap: The maximum interest rate on loans cannot exceed 7.5% above the highest rate offered on deposits.

Simple Formation Process: Less regulatory scrutiny compared to other NBFCs.

Limited Compliance Burden: No RBI intervention in daily operations.

Encourages Community Development: Facilitates small-scale savings and lending for financial inclusion.

+919818211597

info@taxswami.com