Incorporation of a Foreign Company in India

India is one of the fastest-growing economies in the world, making it an attractive destination for foreign businesses. The Indian government has established policies and regulations to facilitate the incorporation of foreign companies, ensuring ease of doing business while maintaining compliance with Indian laws. Foreign companies looking to establish a presence in India can do so through various business structures.

Foreign companies can set up their business in India through the following options:

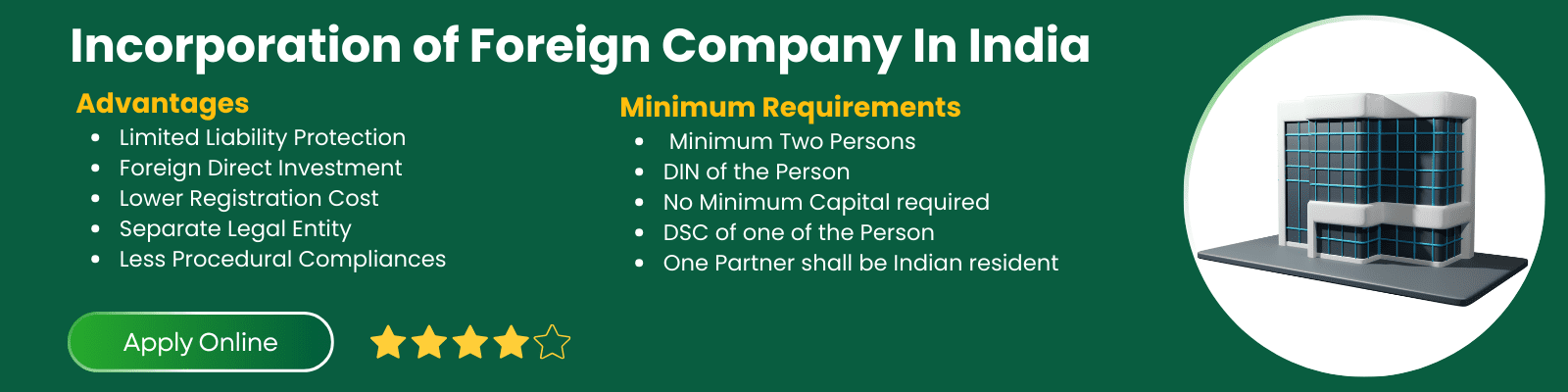

A foreign company can incorporate a wholly owned subsidiary in India by registering it as a private limited company under the Companies Act, 2013. This is a preferred option when 100% Foreign Direct Investment (FDI) is allowed in a specific sector.

A foreign company may enter into a strategic partnership with an Indian company through a joint venture. This option is suitable when FDI restrictions require local participation or when foreign businesses seek local expertise.

A foreign company can establish a liaison office to explore business opportunities, promote the parent company’s interests, and facilitate technical collaboration. However, it cannot engage in commercial activities or generate revenue in India.

A branch office is an extension of the foreign company and is allowed to conduct business activities such as export/import, consultancy services, and research. However, it cannot engage in retail trading or manufacturing.

Foreign companies can set up a project office in India to execute specific projects. This is suitable for businesses engaged in infrastructure, construction, and service contracts.

The first step is to decide the type of business entity based on the company’s objectives and the regulatory framework.

The directors of the foreign company must obtain a DSC and DIN to complete online filings with the Ministry of Corporate Affairs (MCA).

The company must apply for name approval from the Registrar of Companies (ROC) through the online portal of the MCA.

Key documents such as the Memorandum of Association (MoA) and Articles of Association (AoA) must be prepared and submitted along with other required declarations.

The company must submit Form SPICe+ (Simplified Proforma for Incorporating Company Electronically) with the ROC, along with necessary documents and fees.

Upon approval, the ROC issues a Certificate of Incorporation, officially recognizing the company.

The company must obtain a Permanent Account Number (PAN), Tax Deduction and Collection Account Number (TAN), and comply with Goods and Services Tax (GST) registration if applicable.

Foreign companies must comply with the Foreign Exchange Management Act (FEMA), 1999, Reserve Bank of India (RBI) guidelines, and sector-specific FDI policies. They must also file annual returns and financial statements with the ROC and adhere to taxation laws.

+919818211597

info@taxswami.com