GST Registration with Taxswami: A Complete Guide

What is GST Registration? GST (Goods and Services Tax) is an indirect tax levied on the supply of goods and services in India. It replaces multiple indirect taxes such as VAT, service tax, and excise duty. GST registration is mandatory for businesses exceeding the prescribed turnover limits or engaged in inter-state trade, e-commerce, or providing taxable services.

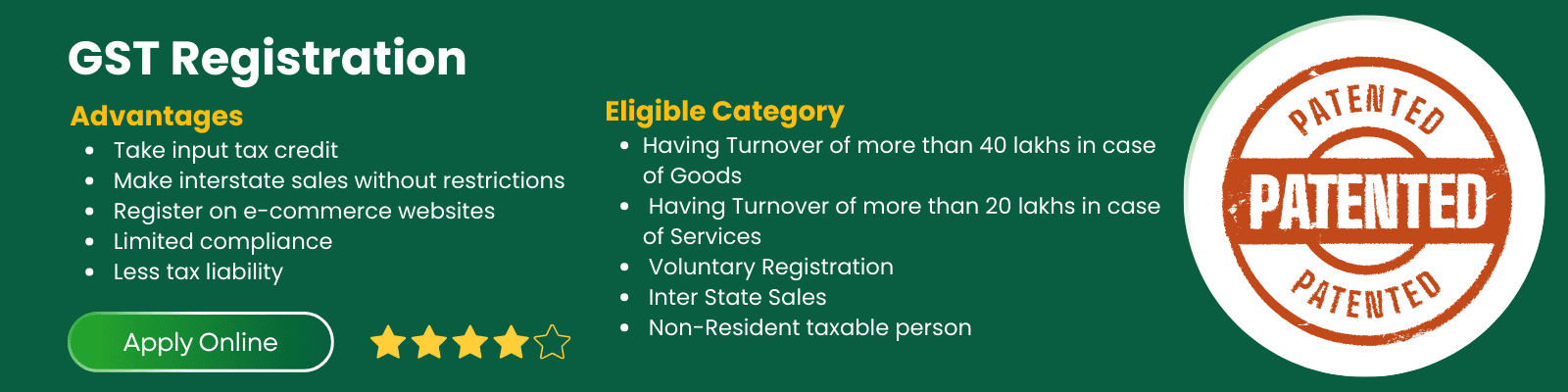

Who Needs GST Registration?

Businesses with an annual turnover exceeding Rs. 40 lakh (Rs. 20 lakh for service providers and Rs. 10 lakh for special category states).

Individuals or businesses engaged in inter-state supply of goods and services.

E-commerce sellers and aggregators.

Casual taxable persons and non-resident taxable persons.

Businesses dealing with taxable goods and services under reverse charge mechanism.

Input Service Distributors (ISD) and agents of a supplier.

Benefits of GST Registration

Legal Recognition: A GST-registered business gains legal recognition and can avail input tax credits.

Avoiding Penalties: Non-compliance with GST regulations results in heavy penalties. Registration ensures adherence to tax laws.

Seamless Business Operations: GST registration enables smooth interstate and international trade without legal hurdles.

Input Tax Credit (ITC): Businesses can claim ITC on GST paid for purchases, reducing the overall tax burden.

Easier Compliance: A unified tax system simplifies compliance by replacing multiple indirect taxes.

Enhanced Business Credibility: Registered businesses gain credibility and trust among suppliers and customers.

Documents Required for GST Registration

PAN Card of the business or applicant.

Aadhaar Card of the proprietor, partners, or directors.

Business address proof (electricity bill, rent agreement, or ownership documents).

Bank account details (cancelled cheque, bank statement, or passbook copy).

Digital signature for companies and LLPs.

Photograph of the owner/promoters.

Business incorporation certificate or partnership deed.

GST Registration Process with Taxswami

Online Application: Visit the GST portal and submit the application with required details and documents.

TRN (Temporary Reference Number): After submission, a TRN is generated for tracking the application.

Verification of Documents: Tax authorities verify the submitted documents.

ARN (Application Reference Number): Once verified, an ARN is issued for future reference.

GSTIN Allocation: Upon successful verification, a unique GST Identification Number (GSTIN) is issued.

Types of GST Registration

Normal Taxpayer: For businesses with turnover exceeding the prescribed limit.

Casual Taxable Person: For businesses operating temporarily.

Composition Scheme: For small taxpayers with turnover below Rs. 1.5 crore.

Non-Resident Taxable Person: For individuals and businesses supplying goods or services in India without a fixed place of business.

+919818211597

info@taxswami.com